The Core of Sustainable Growth

The marketplace is littered with the remnants of companies that had great products, talented people, and impressive initial success, but ultimately failed. Their downfall often wasn’t a lack of vision, but a critical failure in execution: poor capital allocation.

Every dollar a company possesses is a finite resource, and the decision on where to deploy it is the single most crucial action an executive team can take. This isn’t just about managing budgets; it’s about making strategic bets that define your future competitive position.

Defining the Engine of Value Creation

- Strategic Investment Decisions are not simply routine expenditures; they are choices that fundamentally shape the trajectory, capabilities, and competitive advantage of the organization for years to come. Think of building a new factory, acquiring a key technology, or launching a breakthrough R&D initiative.

- Capital Allocation is the disciplined process of distributing those limited financial resources among competing strategic initiatives, operational needs, and shareholder returns, all with the explicit goal of maximizing long-term shareholder value.

Our goal in this comprehensive guide is to move beyond financial metrics and provide you with the strategic framework to make choices that not only keep the lights on but also ignite genuine, sustainable, and exponential growth.

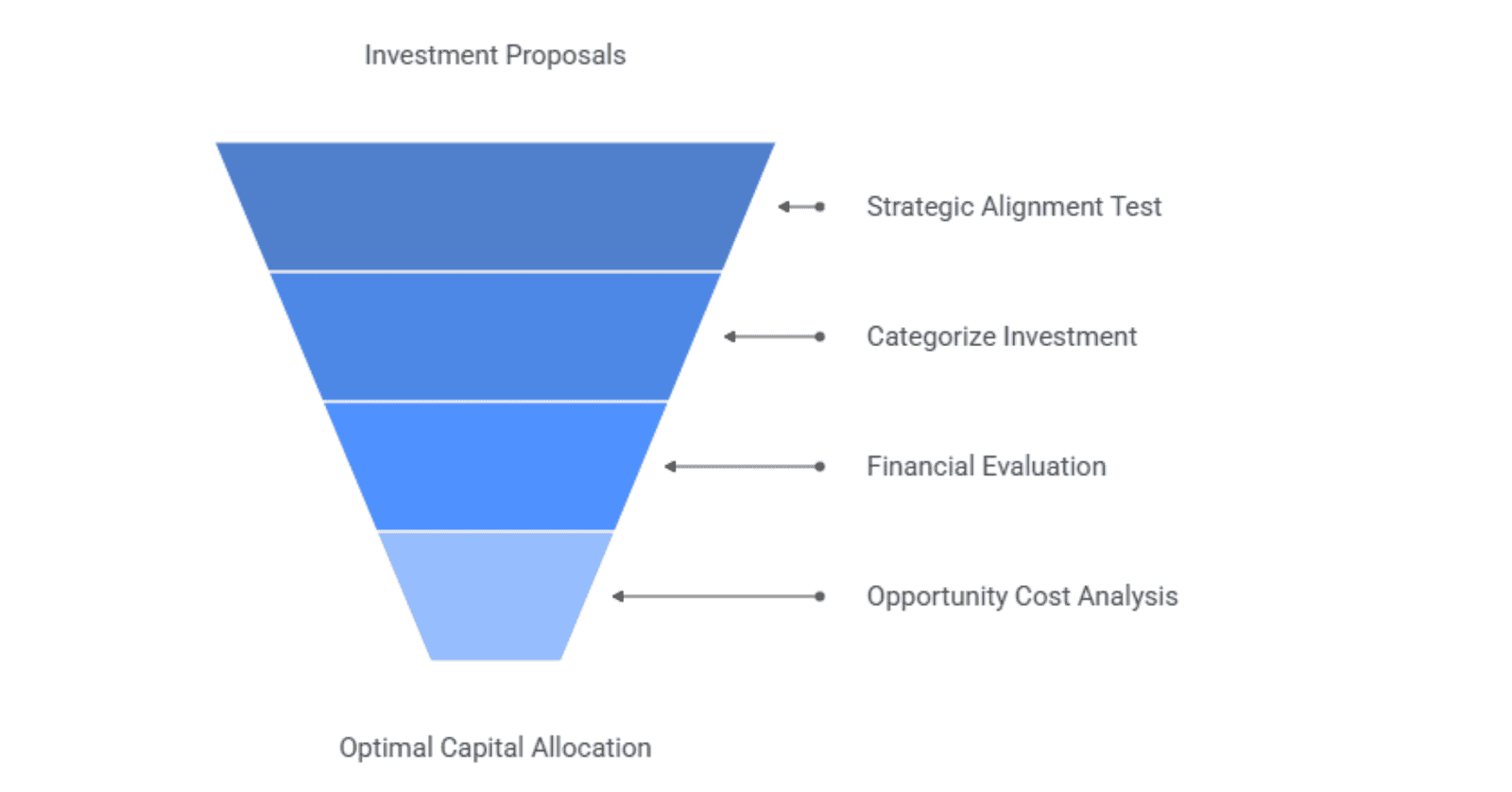

The Strategic Investment Framework

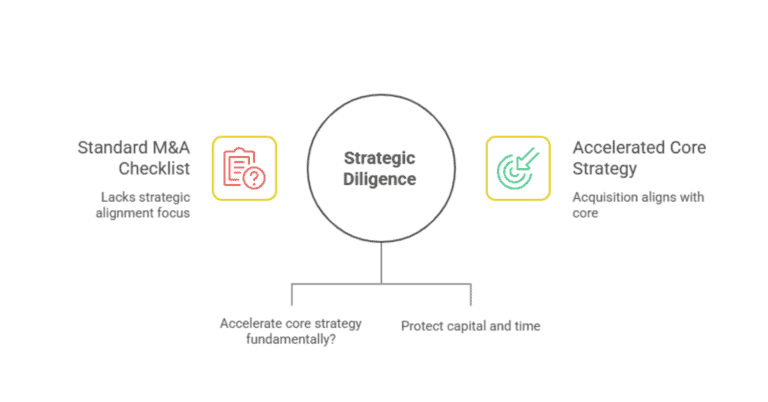

Too often, investment proposals start with an internal rate of return (IRR) calculation. This is putting the cart before the horse. Truly effective capital allocation begins with a clear, unwavering strategy.

Strategy First, Dollars Second: The Mandatory Filter

Every dollar committed must pass the “Strategic Alignment Test.” You must ask: Does this investment directly support our core business strategy and reinforce our competitive advantage?

If your core strategy is “low-cost leadership,” every significant investment, from optimizing the supply chain to automating assembly, must drive down operational costs. If your strategy is “premium product differentiation,” your investments must be in R&D, superior materials, and a world-class customer experience platform. An investment that delivers a great ROI but distracts from the core strategy is a dangerous, value-destroying expenditure.

Three Critical Buckets of Strategic Investment

To gain clarity, categorize every proposed project into one of three buckets. This provides a clear-eyed view of your firm’s risk profile and focus.

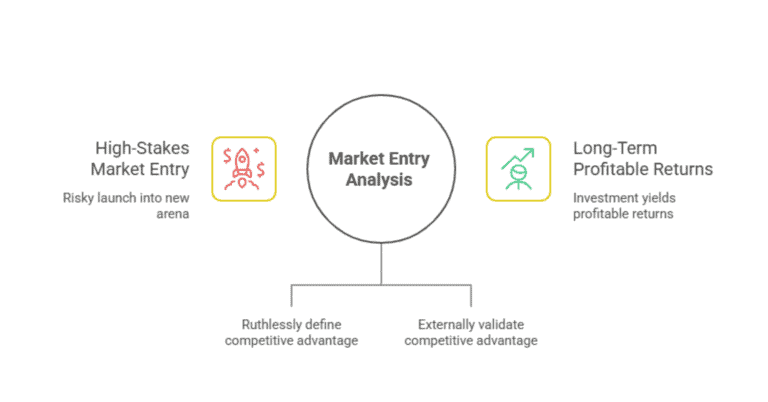

Growth (Offensive)

These are investments designed to expand your competitive landscape. They carry the highest risk but offer the highest potential return.

- Examples: Entering new geographic markets, launching a disruptive new product line (R&D), or strategic mergers and acquisitions (M&A).

- Goal: To capture new value and expand market share.

Maintenance (Defensive/Core)

These are necessary investments that allow you to stay in business, comply with regulations, and defend your existing market share.

- Examples: Upgrading essential IT and cybersecurity infrastructure, replacing aging machinery, and regulatory compliance spending.

- Goal: To protect the continuity and integrity of the current cash-generating business.

Efficiency/Productivity (Optimization)

These investments focus on doing what you already do, but better, faster, or cheaper. They often have a medium-risk profile with reliable, faster returns.

- Examples: Implementing enterprise resource planning (ERP) systems, process automation, or integrating AI to optimize logistics.

- Goal: To improve margins and free up capital and human resources for growth initiatives.

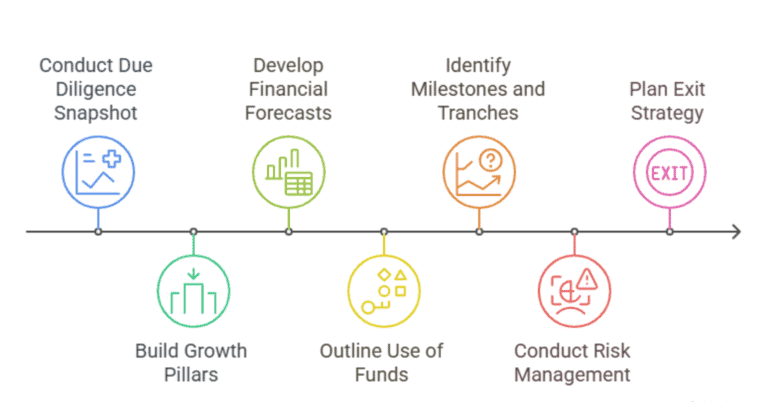

The Concept of “Minimum Viable Investment”

A common mistake is overinvesting in a project before it proves viable. The concept of Minimum Viable Investment (MVI) dictates that you should only spend enough capital to test a strategic hypothesis and validate market interest. By staging your investment and achieving key milestones, you maximize your learning and minimize catastrophic loss if the venture fails.

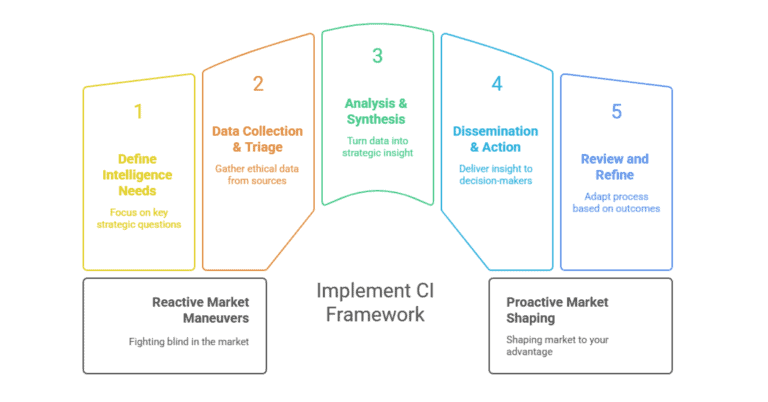

Principles of Effective Capital Allocation

Once the strategic vision is set, the process shifts to rigorous, disciplined analysis. This is where financial acumen meets strategic foresight.

The Financial Evaluation Toolkit for Strategic Investment Decisions

While strategic fit is the starting point, the financial assessment is the essential validation.

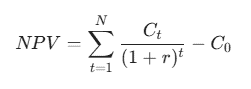

- Net Present Value (NPV): This is the gold standard for comparing projects. It calculates the value of an investment’s expected future cash flows, discounted back to today’s dollars. An investment should only be considered if its NPV is positive, meaning it creates value above the cost of capital.

Where $C_t$ is the net cash inflow during period $t$, $C_0$ is the initial investment, and $r$ is the discount rate.

- Internal Rate of Return (IRR): IRR is useful for initial screening, representing the expected annual rate of return. However, it can be misleading when comparing mutually exclusive projects due to the critical, and often flawed, assumption that intermediate cash flows are reinvested at the IRR itself. Use it with caution.

- Payback Period: This simple metric calculates the time required to recoup the initial investment. While it ignores value creation after the payback point, it is vital for assessing liquidity risk and can be a strong tie-breaker between projects with similar NPVs.

The Opportunity Cost Trap

Capital is a zero-sum game. The decision to fund Project A is simultaneously the decision not to fund Project B, C, and D. This is the opportunity cost, the value of the best alternative foregone.

Effective capital allocators consistently rank potential projects against a firm-wide hurdle rate and against one another. They operate under the assumption that they must earn the right to their capital every single year, even for ongoing initiatives.

The Capital Allocation Mix (The CEO’s Playbook)

A CEO’s ultimate test is designing the optimal capital allocation mix. Capital generated must be distributed across the following options:

- Reinvestment in the Business (CapEx/R&D): Funding the strategic investment buckets outlined above. This is the primary driver of future growth.

- Mergers & Acquisitions (M&A): Buying capabilities, scale, or market share.

- Return to Shareholders: Paying dividends or initiating share buybacks to increase earnings per share (EPS).

- Debt Reduction: Improving the balance sheet and reducing risk.

The optimal mix is not static. A young, high-growth tech company should aggressively reinvest in R&D and CapEx (Bucket 1). A mature, slow-growth utility company might prioritize steady dividends and share buybacks (Bucket 3) as its growth opportunities are fewer. The mix must match the company’s life cycle and current market opportunity.

Common Capital Allocation Pitfalls (and How to Avoid Them)

Even the most innovative teams make capital allocation errors. Recognizing the cognitive biases and organizational pressures is the key to preventing them.

The Sunk Cost Fallacy: The Addiction to Past Spending

The most common trap is the refusal to kill a failing project because “we’ve already invested $X million.” Past expenditures are sunk costs; they cannot be recovered and are irrelevant to forward-looking decisions.

Solution

Implement zero-based budgeting (ZBB) for all major ongoing projects, forcing project owners to justify the next dollar of investment rather than defend the last dollar spent.

The “Shiny Object” Syndrome: Investment Without Strategic Fit

The pressure to adopt the latest trend, be it AI, Blockchain, or a new geographical market, can lead to investment decisions based on fear of missing out (FOMO) rather than a clear strategy.

Solution

Maintain a strict rule: No principal investment proceeds without a clear, testable, and quantifiable link to a defined strategic goal. If you can’t articulate the value proposition in one sentence, don’t fund it.

Under-Investing in the Core: Starving the Cash Cow

Sometimes, companies become so obsessed with the next big venture that they neglect the business currently generating all the cash. Failing to invest in maintenance, efficiency, and continuous improvement in the core product leads to a slow, inevitable decline in quality and competitiveness.

Solution

Mandate that a fixed percentage of operating cash flow be explicitly ring-fenced to maintain and incrementally improve the core business infrastructure.

The Empire Building Bias and Misaligned Incentives

Managers naturally seek larger budgets, bigger teams, and more resources, even if a smaller, more focused initiative would yield a higher return on invested capital (ROIC).

Solution

Tie managerial compensation and bonuses directly to financial metrics that reflect the efficiency of capital use, such as ROIC or Return on Capital Employed (ROCE), rather than gross revenue or team size.

The Capital Allocator’s Mindset

Strategic investment decisions and effective capital allocation are not merely annual events tied to a budget cycle; they are an ongoing process of hypothesis testing, resource redeployment, and strategic renewal.

The successful executive views the company’s balance sheet not as a fixed pool of assets, but as an array of competing opportunities. Their job is not to passively distribute funds, but to act as a portfolio manager, ruthlessly prioritizing, defunding losers, and aggressively funding winners.

The Key Takeaway

The difference between a company that merely survives and one that dominates its market is the intelligence with which it deploys its capital.

Final Call to Action

Take a moment to review your top three current spending initiatives. Do they directly align with your core strategy? Are you investing in growth, or are you trapped in a cycle of defending past mistakes? If you can’t answer that question clearly, it’s time to re-evaluate, reallocate, and set your course for proper, sustainable growth.