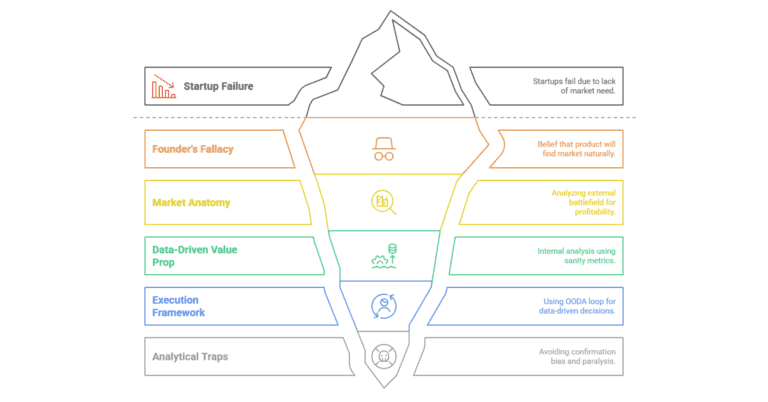

Every moment spent analyzing a misaligned target is a moment lost on a lucrative opportunity. Corporate development teams and private equity firms often fall victim to “diligence fatigue”; the exhaustive, multi-million-dollar process that begins before the core strategic question has been answered.

The cold truth? Time kills deals, but unfocused diligence kills conviction.

You don’t need to commit to a 100-day financial and legal review to determine if a target is fundamentally right for your portfolio. You need a fast, sharp strategic filter; a rapid assessment framework that allows you to conduct the core strategic assessment in minutes, not months.

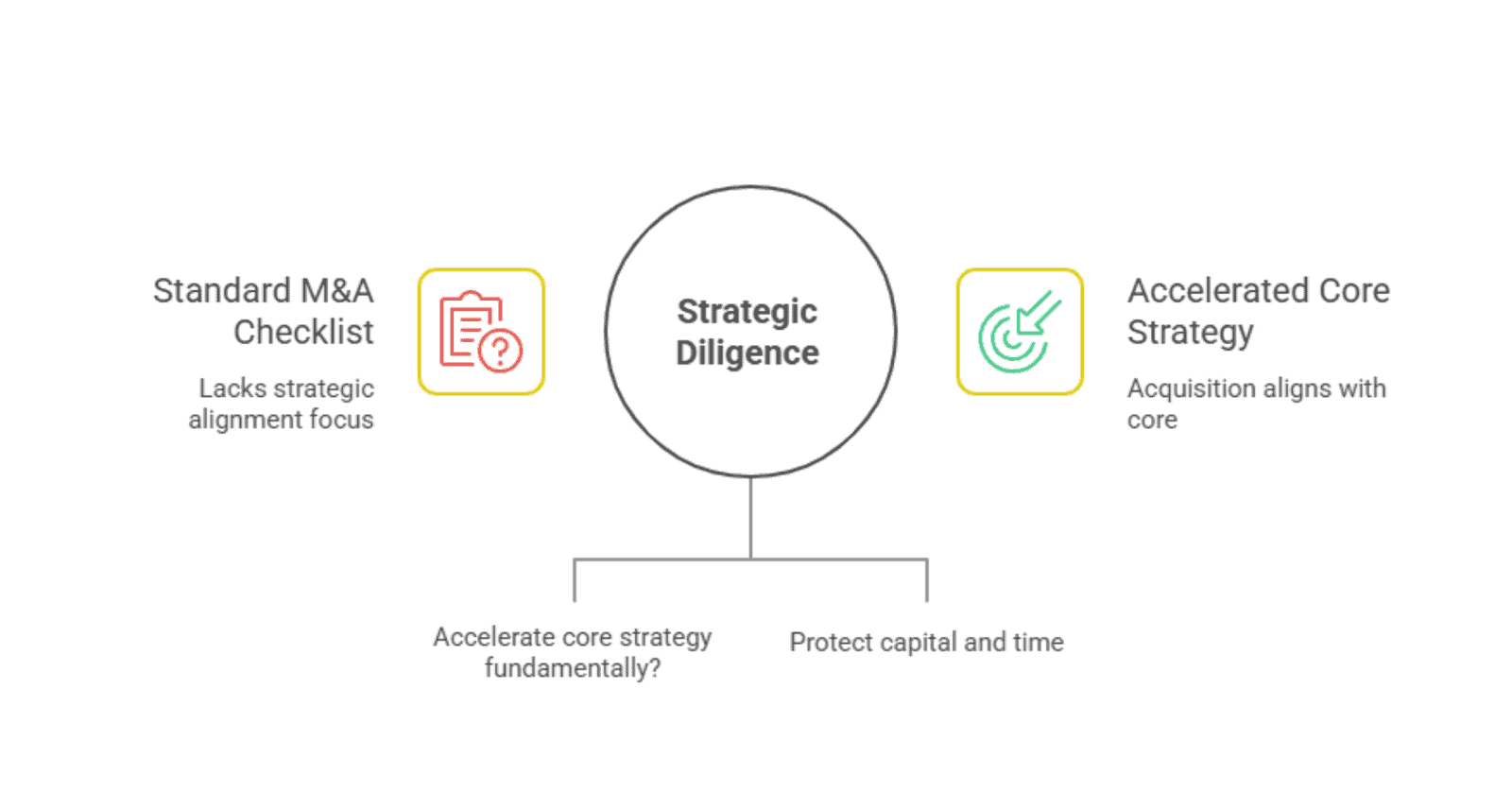

This guide introduces the “Strategic Triage,” moving beyond the standard M&A checklist to ask the single most critical question: Will this acquisition fundamentally accelerate our core strategy? This is not about confirming the P&L; this is Strategic Diligence, a rapid fit-test designed to protect your most valuable resources: capital and time.

The Strategic Filter: Why Speed Trumps Depth (Initially)

The standard playbook for M&A due diligence is flawed. It prioritizes exhaustive data collection (financial, legal, HR, IT) often before the leadership team has confirmed the foundational strategic rationale. This creates a dangerous paradox: Exhaustive initial diligence obscures the simple, fundamental strategic issues. You get lost in the weeds of balance sheets while the critical strategic mismatch, like a fatal cultural chasm or a non-scalable technology, goes unnoticed until the very end.

The cost of this delay is exponential. As deals drag on, the seller’s price creeps up, the best target leadership talent begins to look for new jobs, and competitors gain ground while your resources are tied up in “analysis paralysis.”

The Principle of Strategic Triage is simple: Commit resources only after confirming the fundamental strategic rationale is sound. Use this rapid filter to triage your deal flow, ensuring that only targets with high strategic fit and minimal immediate risk move on to the expensive, resource-intensive full M&A due diligence.

The 3×3 Strategic Fit Matrix: The Rapid Assessment Framework

The most effective strategic consultants use frameworks that force clarity and focus. The 3×3 Strategic Fit Matrix distills the strategic assessment into the nine most critical questions, forcing your team to assign a simple RAG status (Red, Amber, Green) to each box. This delivers a complete strategic snapshot in under an hour.

| Dimension | Question 1: Market | Question 2: Capability | Question 3: Financial Structure |

| A. Rationale (Why Buy?) | A1. Market Power: Does the acquisition grant us critical market share, new geography, or new distribution channels? | A2. Talent & IP: Are the target’s core capabilities (IP/Tech/Team) truly unique, difficult to replicate, and scalable? | A3. Synergistic Cost/Revenue: Is the path to cost or revenue synergy clear, non-speculative, and quantifiable in the short term (12-18 months)? |

| B. Risk (What Could Fail?) | B1. Competitive Response: How quickly and effectively will the top competitors retaliate or copy the strategy enabled by the merger? | B2. Cultural Chasm: Is the target’s operating model and culture fundamentally compatible with ours, or is a painful integration inevitable? | B3. Debt & Liabilities: Are there any immediate, unmanaged financial liabilities, off-balance-sheet items, or toxic debt structures? |

| C. Future (What’s Next?) | C3. Technology Horizon: Does the target’s core technology have runway, or is it facing immediate obsolescence or a massive re-platforming cost? | C4. Leadership Retention: Will the core leadership team stay for the integration period, and is their compensation/vesting reasonable? | C5. Integration Complexity: What are the three largest, non-negotiable complexity factors (e.g., system merge, regulatory hurdles)? |

Rationale (The Value Driver)

These questions confirm if the value thesis for the acquisition is robust and achievable.

- A1. Market Power: This is a geography or channel assessment. Is the target giving you something immediately scalable that you couldn’t build yourself in two years? If the answer is “no,” the rationale is weak.

- A2. Talent & IP: Are you buying a team or a patent? If the value proposition relies on unique, irreplaceable human capital or proprietary technology, assign a Green. If the technology is easily replicated, assign a Red.

- A3. Synergistic Cost/Revenue: Synergies are the most common driver of M&A failure because they are often speculative. A Green status here means you have a detailed, non-speculative path to achieving cost savings or revenue uplift within 18 months, backed by data.

Risk (The Deal Killers)

These questions identify immediate threats that can derail the acquisition regardless of how good the rationale is.

- B1. Competitive Response: If acquiring this target instantly puts you in a price war with a deeper-pocketed rival, the strategy is unsustainable. A fast, aggressive competitive response means a high-risk Amber or Red.

- B2. Cultural Chasm: This is often cited as the #1 reason M&A fails. A massive mismatch in operating style (e.g., a formal, waterfall enterprise acquiring an agile, fast-moving startup) creates fatal cultural fit problems that no amount of integration planning can solve.

- B3. Debt & Liabilities: Are there skeletons in the closet? This requires a quick review of the debt structure and a discussion of any known, unmanaged legal or environmental liabilities that haven’t been accounted for in the valuation.

Future (The Integration Challenge)

These questions look past the close date to the immediate challenges of integration.

- C3. Technology Horizon: Is the target’s core platform running on legacy code that will require an immediate, massive re-platforming effort? This hidden cost can wipe out all projected synergy and turn a Green Rationale into a Red Deal.

- C4. Leadership Retention: The value of the acquisition often resides in the founders and key executives. If their vesting schedules are unreasonable or if there’s no clear plan for their retention post-close, the team walks, and the value evaporates.

- C5. Integration Complexity: Identify the top three non-negotiable complexity factors. Is it merging five different ERP systems? Is it navigating complex foreign regulatory approvals? If these three hurdles are insurmountable, the integration complexity is too high.

The Triage Rule

In your rapid strategic assessment, if any of the nine boxes are a solid Red, the strategic rationale is immediately at risk. Stop, reassess, or walk away. Never let an attractive valuation blind you to a fundamental strategic mismatch.

The Five-Minute Red Flag Rapid Scan (The Anti-Checklist)

Before you even start the 3×3 Matrix, conduct this rapid scan using public data and quick, high-level conversations. These are immediate, non-negotiable deal-breakers. Think of them as the five-minute firewall for your deal flow.

- Founder Dependency (The Single Point of Failure): Does the entire business operation rely on one founder, CEO, or technical guru? If the answer is yes, you are not buying a company; you are buying a hostage. Without a deep, distributed leadership bench, the deal is a Red Flag.

- Churn Shock (The Hidden Attrition): Ask for the last 12 months of customer retention data, specifically looking for recent, massive customer drop-offs. Sometimes a high average retention rate masks a sudden, devastating spike in churn over the last two quarters.

- Concentration Risk (The Ticking Time Bomb): If more than 20% of the target’s revenue comes from a single customer, you are inheriting a key vulnerability. That customer relationship becomes the most valuable and fragile asset in the deal. The loss of that single account post-close immediately devalues the entire acquisition.

- IP Ownership (The Legal Ambiguity): Conduct a simple review to confirm that the core Intellectual Property (IP), the reason you are buying the company, is 100% owned by the target entity, not licensed from a founder’s previous company or dependent on third-party contracts. Ambiguous IP ownership is a fire risk.

- Regulatory Blackout (The Future Killer): Are there immediate, known, or pending regulatory changes (government, environmental, or industry-specific) that will fundamentally devalue the core business model? This requires an external, quick check with a specialized lawyer.

From Triage to Commitment

Mastering the strategic assessment in minutes is the hallmark of a successful corporate development team. You will stop wasting resources on fundamentally wrong deals and focus your energy on high-potential opportunities.

The Strategic Triage and the Red Flag Scan give you the conviction, or the caution, you need to justify the next, more expensive phase of financial due diligence.

If your 3×3 Matrix is predominantly Green and the Red Flag Scan is clear, proceed immediately to full diligence. If not, save your resources, protect your mandate, and pivot to the next opportunity in your deal flow.

You don’t need a thousand pages to know if you’re buying the right future. You need the right 9 questions.