Are you operating with blind spots? Every quarter, countless leadership teams dutifully perform a SWOT analysis, listing their Strengths, Weaknesses, Opportunities, and Threats, only to file the resulting pages away, having gained zero meaningful strategic direction.

The problem isn’t the tool; it’s the application. A SWOT analysis is not a simple inventory; it’s a dynamic strategic framework. When conducted properly, it provides the razor-sharp clarity needed to transform mere potential into market-dominating action.

In this guide, we’ll move beyond the basic listing exercise and show you how to conduct a high-impact SWOT analysis that drives real, profitable decisions.

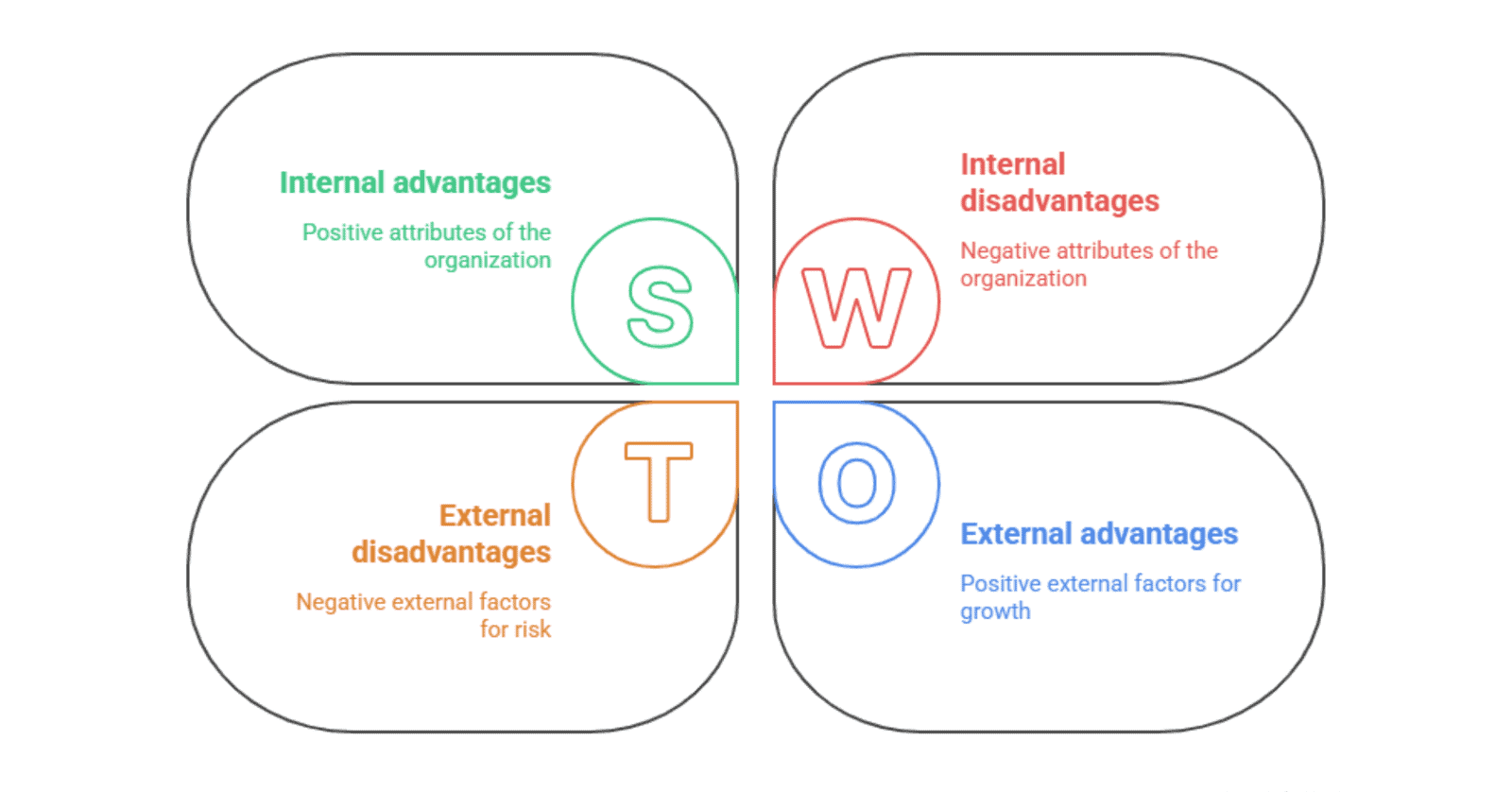

The Four Pillars: A Deep Dive into S-W-O-T

To yield strategic value, each of the four components must be assessed with ruthless honesty and precision. Remember the fundamental distinction: Strengths and Weaknesses are internal (you control them), while Opportunities and Threats are external (you react to them).

S – Strengths: What You Do Best (Internal, Positive)

Your strengths are the core competencies, unique resources, and competitive advantages that distinguish you in the market.

- Key Focus: A true strength must be value-generating and difficult for competitors to imitate. If everyone has it, it’s not a strength; it’s a standard requirement.

- Questions to Ask: What proprietary assets do we possess? What makes a customer consistently choose us over the competition?

- Example: A patented technology, a highly efficient supply chain, or exceptional brand loyalty driven by superior customer service.

W – Weaknesses: Areas for Improvement (Internal, Negative)

These are internal limitations or deficiencies that currently hinder your performance or ability to execute a strategy.

- Key Focus: Distinguish between a minor flaw and a strategic weakness that must be immediately addressed because it leaves you vulnerable.

- Questions to Ask: Where do we consistently lose to competitors? Which internal processes are inefficient or cost-prohibitive?

- Example: High employee turnover in key departments, outdated IT infrastructure, or reliance on a single, aging manufacturing facility.

O – Opportunities: Untapped Potential (External, Positive)

Opportunities are favorable external conditions that your business can capitalize on to gain an advantage or accelerate growth.

- Key Focus: Opportunities are time-sensitive. They exist whether or not you act on them, but your competitors may move first.

- Questions to Ask: What market trends are emerging right now? Are there any regulatory shifts or demographic changes creating a new need?

- Example: A major competitor exiting a key geographic market, the development of a complementary technology you could integrate, or new government incentives for green energy adoption.

T – Threats: External Risks (External, Negative)

Threats are external factors that could jeopardize your current business operations, profitability, or future viability.

- Key Focus: Threats demand contingency planning. Ignoring them is inviting a crisis.

- Questions to Ask: Who are the rising disruptive competitors? What macroeconomic factors (like inflation or supply chain risks) could hurt demand or raise costs?

- Example: A new, low-cost entrant in the market, rising raw material costs due to geopolitical instability, or the rapid obsolescence of your current core product.

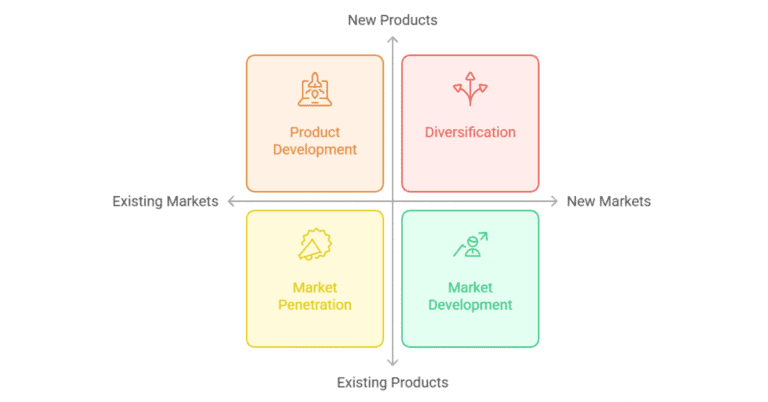

The Strategist’s Edge: Turning SWOT into Action

The most powerful phase of the analysis involves pairing the elements to generate strategic initiatives. This is where the simple list becomes a roadmap.

| Combination | Strategy Type | Goal | Action Mandate |

| S + O | Maxi-Maxi (Aggressive) | Use your Strengths to capitalize on Opportunities. | Attack & Grow |

| S + T | Maxi-Mini (Leveraging) | Use your Strengths to minimize or avoid Threats. | Defend & Protect |

| W + O | Mini-Maxi (Turnaround) | Overcome Weaknesses to pursue Opportunities. | Invest & Pivot |

| W + T | Mini-Mini (Survival) | Minimize Weaknesses and avoid Threats. | Retrench or Divest |

Action Step Example

- Scenario: You identify your Strengths as a highly-trained, stable engineering team (S), but note a Threat as a new regulation that requires significant product redesign (T).

- Strategy (S + T): Use the stable, skilled engineering team (S) to proactively and quickly redesign the product to meet the new regulation (T), turning a threat into an early-mover advantage.

Common Pitfalls to Avoid

As a business strategist, your job is to guide the team away from these typical mistakes:

- The Categorization Error: Be meticulous. A weak sales pipeline is an internal Weakness (W); a tightening credit market is an external Threat (T). Mixing them muddies the action plan.

- The “Vanity List”: Avoid listing irrelevant or obvious items. Focus only on the 3–5 items in each quadrant that have the most strategic impact on your short- and long-term goals.

- Failing to Prioritize: You cannot tackle everything. Once the matrix is complete, leadership must explicitly rank the most critical action mandates and assign ownership.

- The One-Time Exercise: SWOT must be a living document. Market conditions change constantly, so commit to reviewing and updating your analysis and action mandates at least quarterly.

Your Call to Strategy

The simple SWOT analysis sheet you fill out is not the destination; it is merely the first step in meaningful strategic planning. The value lies entirely in the matrix pairings, the S-O, S-T, W-O, W-T combinations, that force you to link your current reality with future possibilities.

Stop maintaining a list of facts and start building a plan for growth.