Defining Your Growth Strategy

Every business, from a budding startup to a multinational corporation, faces the same fundamental challenge: how to grow. Growth isn’t just about getting bigger; it’s about sustainable evolution, staying relevant, and securing a future in an ever-changing market. But with countless paths to expansion, how do you choose the right one? How do you assess the risks and potential rewards of each direction?

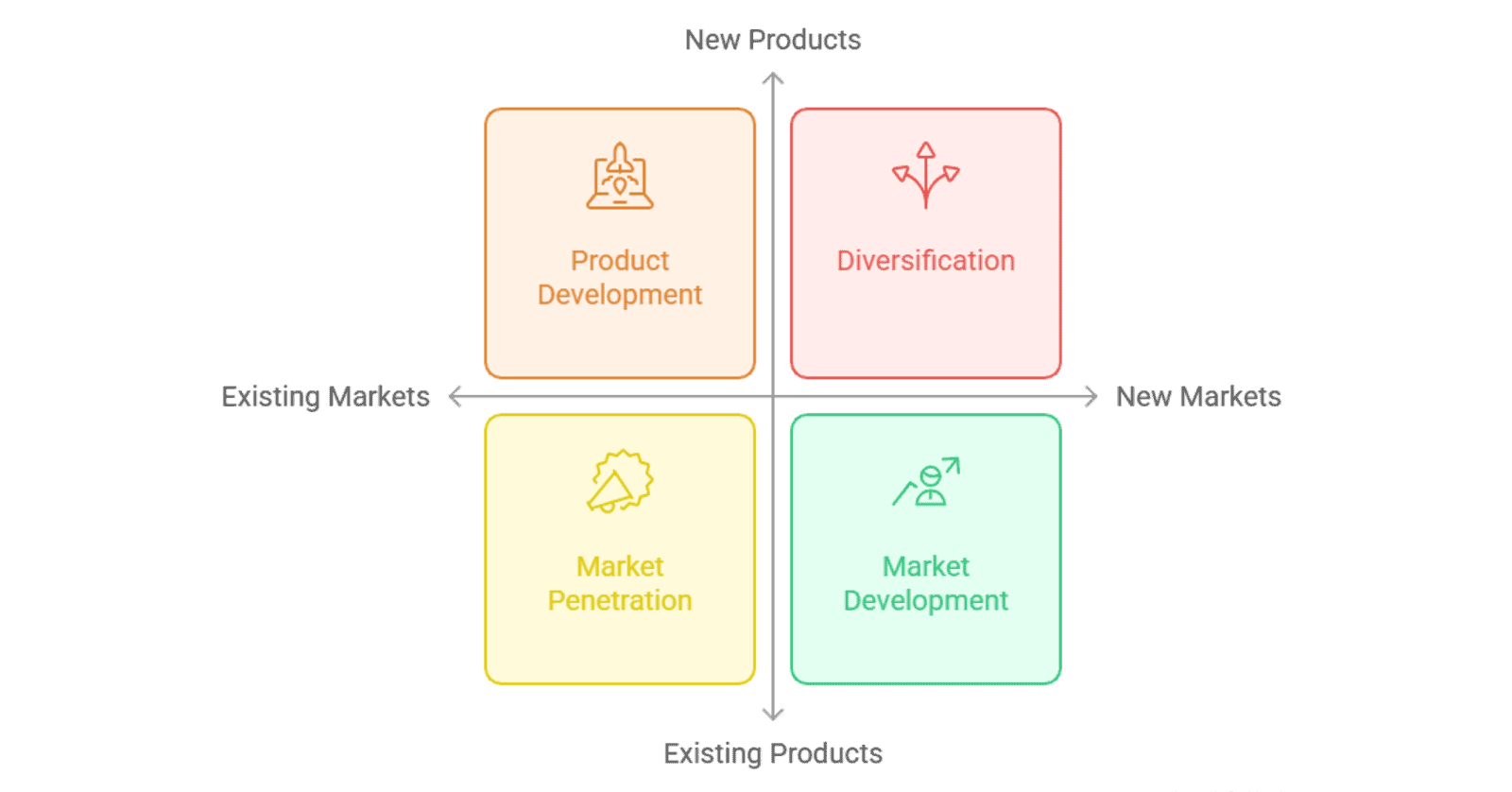

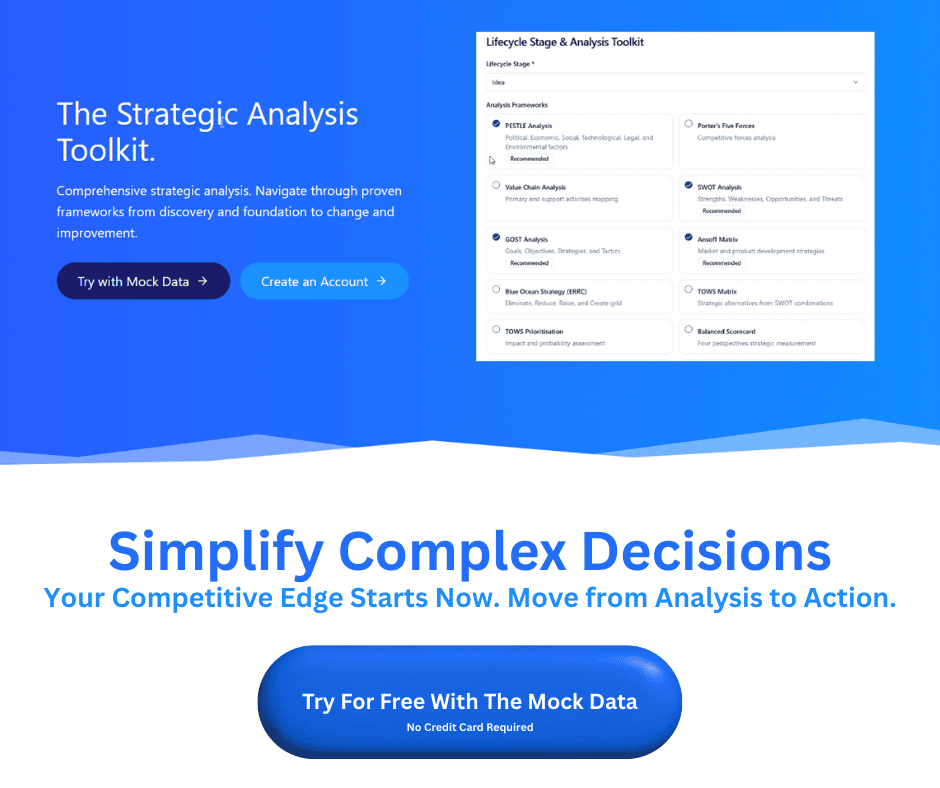

Enter the Ansoff Matrix, also known as the Product-Market Expansion Grid.

Developed by Igor Ansoff, this powerful strategic tool provides a clear framework for businesses to identify and evaluate four primary growth strategies based on whether they use current or new products and target current or new markets. It’s a foundational concept for anyone looking to map out their future.

It’s an essential read for business owners, strategists, marketing managers, and product developers eager to make informed decisions about their company’s trajectory.

Deconstructing the Matrix: The Four Strategies

Let’s dive into each of the four quadrants, detailing the strategy, its typical tactics, and, critically, its associated risk profile. Understanding these distinctions is key to making strategic choices.

Quadrant 1: Market Penetration (Current Product, Current Market)

- Strategy: This is arguably the most common and often the initial growth strategy. It focuses on increasing market share within your existing customer base by selling more of your current products to the customers you already have or can easily reach.

- Tactics: Think aggressive pricing strategies, enhanced promotional campaigns (advertising, sales promotions), increasing distribution channels, or even acquiring competitors to consolidate market share.

- Risk Profile: This quadrant represents the Lowest Risk. You’re dealing with known products in known markets, leveraging existing relationships and proven capabilities.

Quadrant 2: Market Development (Current Product, New Market)

- Strategy: With this approach, you take your existing, successful products and introduce them to entirely new markets. The product remains the same, but the audience changes.

- Tactics: This could involve geographic expansion (e.g., launching in a new country or region), targeting new customer segments (e.g., selling a B2C product to B2B clients), or identifying new use cases for your existing product that appeal to a different segment.

- Risk Profile: Medium Risk. While your product is proven, you’re venturing into unfamiliar territory, with new customer needs, a changing competitive landscape, and evolving regulatory environments.

Quadrant 3: Product Development (New Product, Current Market)

- Strategy: Here, the focus shifts to innovation. You develop new products or services to sell to your existing customer base. You leverage your understanding of your current customers’ needs and trust to introduce something new.

- Tactics: This can manifest as launching improvements or variations of current products, bundling new services alongside your core offering, or even introducing entirely new product lines that cater to the same customer base’s broader needs.

- Risk Profile: Also a Medium Risk. You know your customers well, but the success of a new product is never guaranteed. There’s always the chance it won’t resonate as expected or that development costs will outweigh returns.

Quadrant 4: Diversification (New Product, New Market)

- Strategy: This is the boldest leap. Diversification involves entering a new market with a new product. It’s about exploring entirely new business opportunities.

- Tactics: Diversification can involve leveraging existing capabilities, technology, or brand reputation (e.g., a car manufacturer moving into electric-vehicle charging stations). Or it can be Unrelated, where you enter an entirely new industry with no obvious synergy (e.g., a food company buying a textile manufacturer).

- Risk Profile: This quadrant represents the Highest Risk. Everything is new and untested; both the product and the market. The learning curve is steep, and the potential for failure is significant. However, the rewards of successful diversification can be substantial, offering new revenue streams and reducing dependence on existing markets.

Applying the Ansoff Matrix: A Practical Guide

Understanding the quadrants is one thing; applying them is another. Here’s a practical guide to using the Ansoff Matrix in your strategic planning:

Step 1: Analyze Your Current Position

Before you look outward, look inward. What are your core competencies? What is your current market share, and where are your products in their lifecycle? A clear understanding of your starting point is crucial.

Step 2: Evaluate Risk vs. Reward

Use the matrix to categorize and formally assess potential growth opportunities. The matrix isn’t just a classification tool; it acts as a risk gauge. For each potential strategy, ask:

- How well do we understand this market?

- How strong is our product/service in this context?

- What are the potential gains versus the investment and potential losses?

Step 3: Prioritize and Sequence

Rarely does a business pursue just one strategy. The most robust growth plans involve a balanced portfolio. You might use Market Penetration to achieve short-term revenue gains and stability, while simultaneously investing in Product Development for future innovation and exploring Diversification to drive long-term survival and new growth engines.

Case Study Examples

- Market Penetration: Consider a popular coffee chain that introduces a new loyalty program or limited-time promotional offers to encourage existing customers to visit more often and increase their average spend. They’re not changing their product or targeting new customers, just getting more from their current base.

- Diversification: Think of Amazon. Starting as an online bookstore (Market Penetration), it gradually moved into selling a vast array of products (Product Development) and expanded globally (Market Development). Its venture into Amazon Web Services (AWS) was a prime example of diversification; a new product (cloud computing services) for a new market (other businesses needing scalable IT infrastructure). This unrelated diversification transformed Amazon into a tech giant beyond e-commerce.

Moving from Strategy to Execution

The Ansoff Matrix is a powerful diagnostic tool that helps frame your strategic choices. It forces you to think systematically about where and how you want to grow. However, remember that the matrix is a starting point; it helps define the choice, but it doesn’t guarantee success.

The most successful businesses don’t stick rigidly to one quadrant. Instead, they strategically manage a mix of growth initiatives, consciously navigating the associated risks and balancing short-term gains with long-term vision. By understanding where each potential growth path sits on the risk spectrum, you can make more informed, deliberate decisions that truly propel your business forward.

Now, it’s your turn: Which quadrant is your primary focus for the next 12 months, and why?