Every small to medium-sized business (SMB) owner dreams of the “hockey stick” growth curve. You have the vision, the passion, and perhaps even early traction. Yet, when it comes time to fuel that growth with outside capital, the conversation often stalls.

Why?

It’s rarely because the business idea is bad. It’s because the growth plan is insufficient.

Investors, whether angel groups, venture capitalists, or even sophisticated bank loan officers, do not invest in “activities.” They invest in returns. Most SMB business plans are laundry lists of things the owner wants to do (hire a sales rep, buy new software, rent a bigger office). They fail to articulate how those activities convert into measurable enterprise value.

To bridge this gap, you need to shift from an operator’s mindset to a capital allocator’s mindset. You need more than a business plan; you need an Investor-Ready Roadmap.

This guide will walk you through the four phases of building a strategic plan that doesn’t just ask for money, it proves you know exactly how to multiply it.

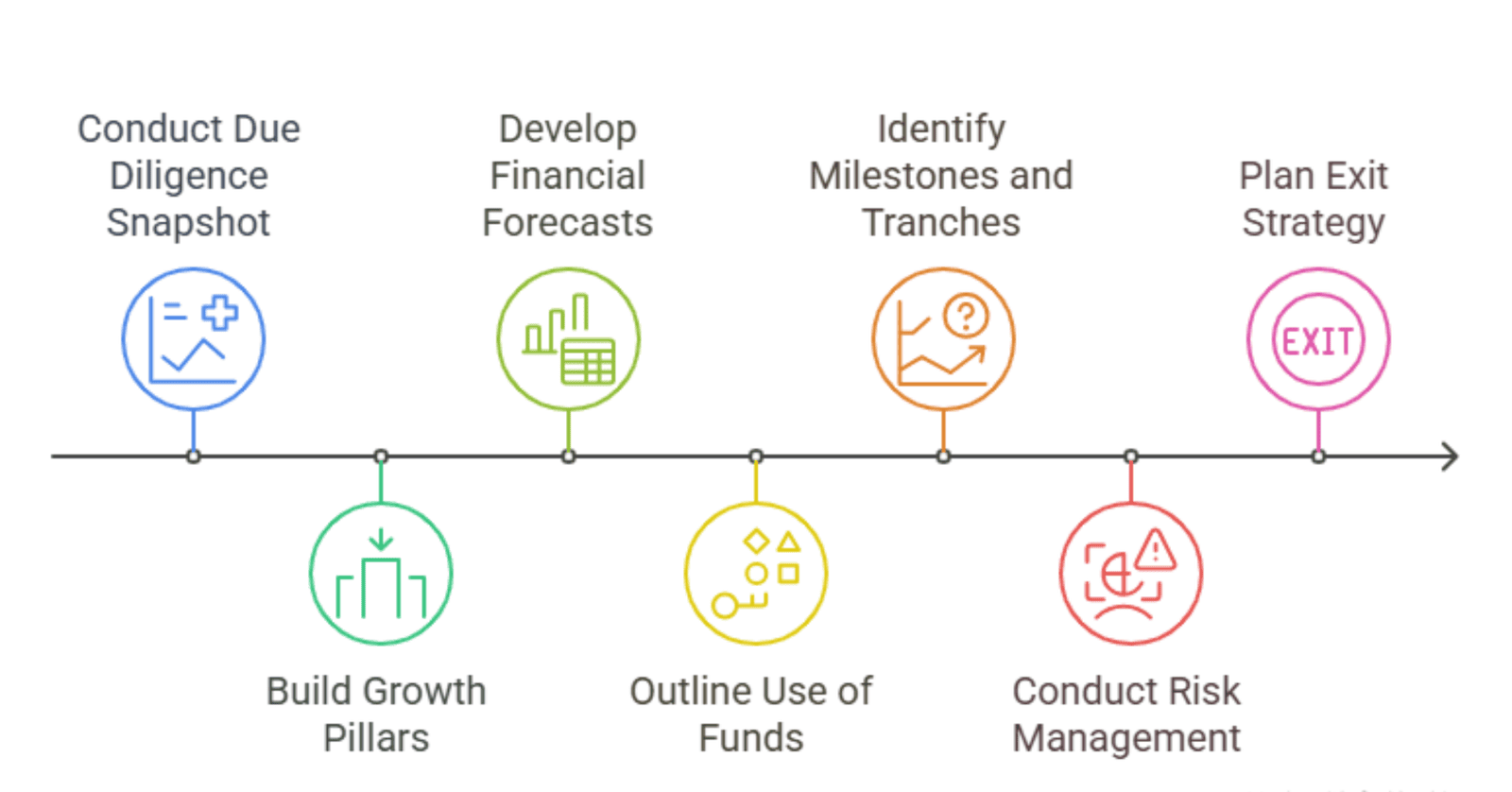

Phase 1: The Due Diligence Snapshot (Solidifying the Foundation)

Before you can sell a vision of the future, you must prove you have a firm grip on the present. Investors start with “Due Diligence“, a rigorous audit of your business health. An investor-ready roadmap pre-empts this by presenting the complex data upfront.

The Financial Health Check

You must move beyond basic P&L statements. Investors are looking for the unit economics that drive your engine. If you don’t know these numbers, you aren’t ready for capital.

- Recurring Revenue ($MRR / $ARR): If you have a subscription model, Monthly Recurring Revenue ($MRR) is your heartbeat. It shows stability.

- Customer Acquisition Cost ($CAC) vs. Lifetime Value ($LTV): This is the golden ratio of growth.

- $CAC: How much total sales and marketing spend does it take to acquire one customer?

- $LTV: How much profit does that customer generate over their life with you?

The Rule of Thumb

Investors generally look for a ratio where $LTV > 3 \times $CAC. If your ratio is 1:1, you are losing money on growth.

Tip

Don’t just show the current number. Show the trend. Is your $CAC decreasing as your brand awareness grows? That is a signal of scalability.

Market Validation: TAM, SAM, and SOM

“Everyone is our customer” is a red flag. You need to quantify your opportunity using the standard market sizing framework:

- Total Addressable Market (TAM): The total market demand for your product.

- Serviceable Available Market (SAM): The segment of the TAM targeted by your products and services, which is within your geographical reach.

- Serviceable Obtainable Market (SOM): The portion of SAM that you can capture.

Use a “bottom-up” approach to calculate this. Instead of saying “We will take 1% of a $1 billion market,” say:

“There are 5,000 dental practices in the Tri-State area. We charge $2,000/year. Our SOM is $10M.”

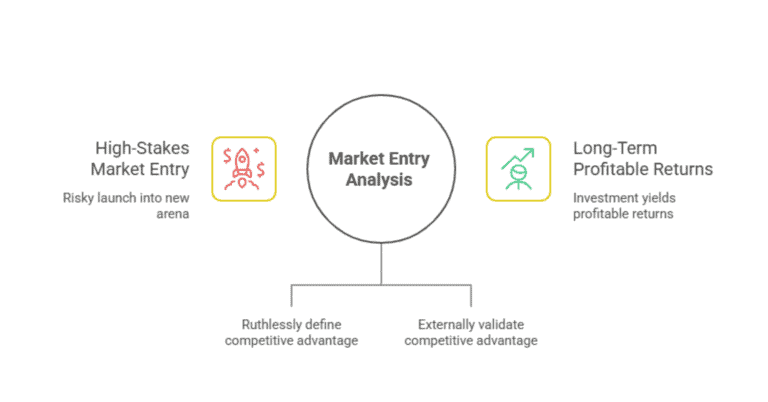

The Competitive Moat

Why won’t a larger competitor crush you the moment you start succeeding? Your roadmap must define your “Moat”, the structural advantage that protects your margins. This could be:

- Proprietary Tech: IP or patents that are hard to replicate.

- Network Effects: The product gets better the more people use it.

- High Switching Costs: It is painful for customers to leave you.

Phase 2: Building the Growth Pillars (The Strategic “How”)

Once the foundation is set, articulate the journey. This is where you connect the capital you are asking for to specific strategic outcomes.

The 3-Year Vision Statement

Where will the company be in 36 months? This needs to be a concrete, quantifiable destination, not a vague aspiration.

- Bad Vision: “We want to be the leading provider of pet grooming software.”

- Investor-Ready Vision: “We will achieve $8M ARR, capturing 15% of the Northeast market, with a gross margin of 75%.”

Strategic Pillars

To achieve that vision, you cannot do everything at once. You must focus on 3 to 5 “Growth Pillars.” These act as the chapters of your roadmap.

Pillar 1: Market Expansion

Are you growing by selling more to existing clients (Upsell/Cross-sell) or by finding new ones? If you are entering a new geography or vertical, outline the specific go-to-market strategy for that expansion.

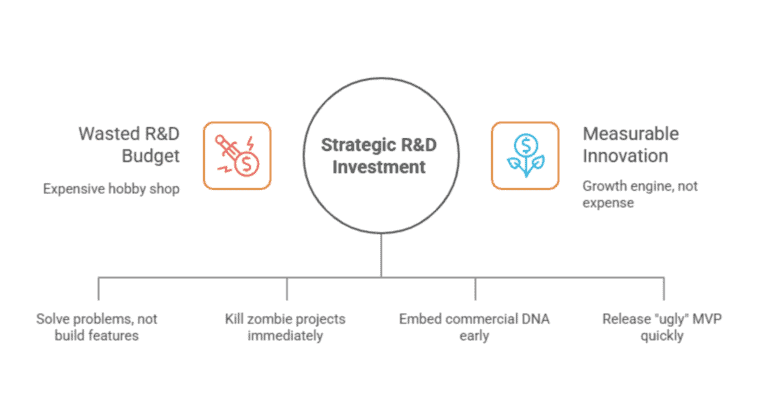

Pillar 2: Product Velocity

Growth often requires product evolution. This pillar details the R&D needed to stay ahead. Are you launching a mobile app? Integrating AI? This isn’t just “coding”; it’s building assets that increase your Enterprise Value.

Pillar 3: Revenue Engine Optimization

This is often the most critical pillar for investors. How will you scale sales?

- Moving from founder-led sales to a dedicated sales team.

- Establishing a channel partner program.

- Automating lead generation.

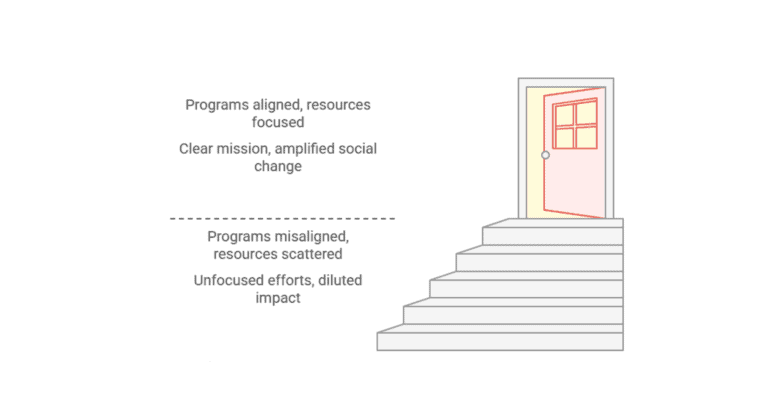

For every pillar, you must map the Resource Allocation. If Pillar 1 is your priority, your budget should reflect that. If you say you are a “product-led company” but allocate 80% of your budget to billboard ads, your roadmap is broken.

Phase 3: Financial Forecasting and The “Ask”

This is the section where the rubber meets the road. You must translate your Strategic Pillars into a financial model.

The Pro Forma Financials

Investors know your projections are wrong. They aren’t looking for a crystal ball; they are looking for the logic behind your assumptions.

Create a model with three scenarios:

- Conservative: The “keep the lights on” plan.

- Expected: The plan you are actually executing against.

- Aggressive: The “moonshot” is if every variable hits perfectly.

Document Your Drivers:

Never hard-code revenue numbers. Revenue should be calculated based on controllable drivers.

$$Revenue = Traffic \times Conversion Rate \times Average Order Value$$

If you project revenue doubling, show which of those three variables is changing and why.

The Use of Funds (The “Ask”)

Be specific. “We need $2 million for growth” is insufficient.

Instead, use a breakdown tied to your pillars:

- 40% (Sales & Marketing): Hiring 3 AEs and a VP of Marketing to execute Pillar 3.

- 30% (Product): Expanding the dev team to launch the V2 Platform (Pillar 2).

- 20% (Operations): Client success hires to maintain low churn.

- 10% (Working Capital): Buffer for cash flow variance.

Milestones and Tranches

Savvy investors often “tranche” their investment (release it in stages). Your roadmap should align with this.

“We are asking for $2M total. We need the first $1M to reach $500k ARR. Once we hit that milestone, the second $1M is unlocked to scale to $2M ARR.”

This demonstrates that you are disciplined and results-oriented.

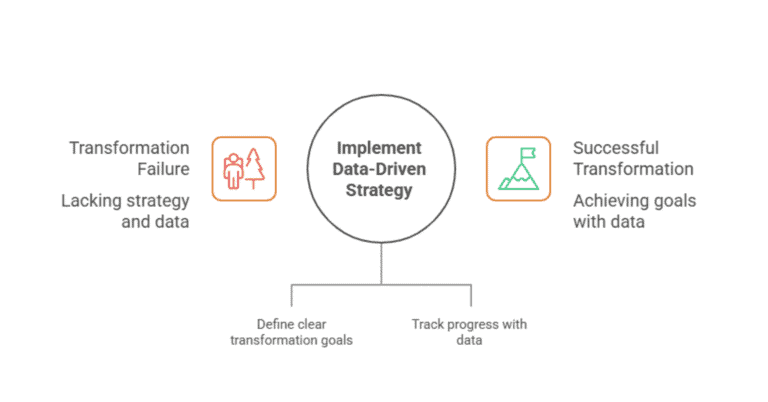

Phase 4: Risk Management and The Exit

The hallmark of an amateur business plan is the absence of risk analysis. The hallmark of a professional roadmap is a candid discussion of potential risks.

The Pre-Mortem

Identify the top 3-5 risks to your plan.

- Market Risk: What if the market adopts the tech more slowly than expected?

- Management: We have a low-cost “Lite” version to reduce the barrier to entry.

- Platform Risk: Reliance on a third-party platform (e.g., Facebook Ads).

- Management: diversifying channels to SEO and email marketing immediately.

- Talent Risk: Inability to hire key engineers.

- Management: We have allocated an above-market equity pool for early hires.

The ROI: How Do They Get Out?

Investors need liquidity. You are building this roadmap to sell the company or go public eventually. You don’t need a signed contract, but you need a logical conclusion.

- Strategic Acquisition: List 5-10 companies that would benefit from buying you in 5 years. Why would they buy you? (Technology, customer base, talent?)

- Financial Sale: Selling to a Private Equity firm once you hit a certain EBITDA threshold.

A Living Document

Creating an Investor-Ready Roadmap is demanding. It requires you to dig deep into your metrics, question your assumptions, and articulate a clear path through the fog of uncertainty.

However, the value of this document extends far beyond raising capital. Even if you never take outside investment, this process forces you to run a better business. It clarifies your vision, aligns your team, and focuses your resources on the activities that actually drive growth.

Your next step?

Don’t write this in a vacuum. Start with Phase 1. Open your spreadsheet this week and calculate your valid $CAC and $LTV. If the math works, the money will follow.