The Criticality of the “Edge”

Here is a sobering statistic: 9 out of 10 new market entries fail. This high failure rate isn’t usually due to a lack of funding or effort; it’s due to a lack of a defensible strategy. In other words, they failed because they didn’t define, validate, and execute on their competitive edge.

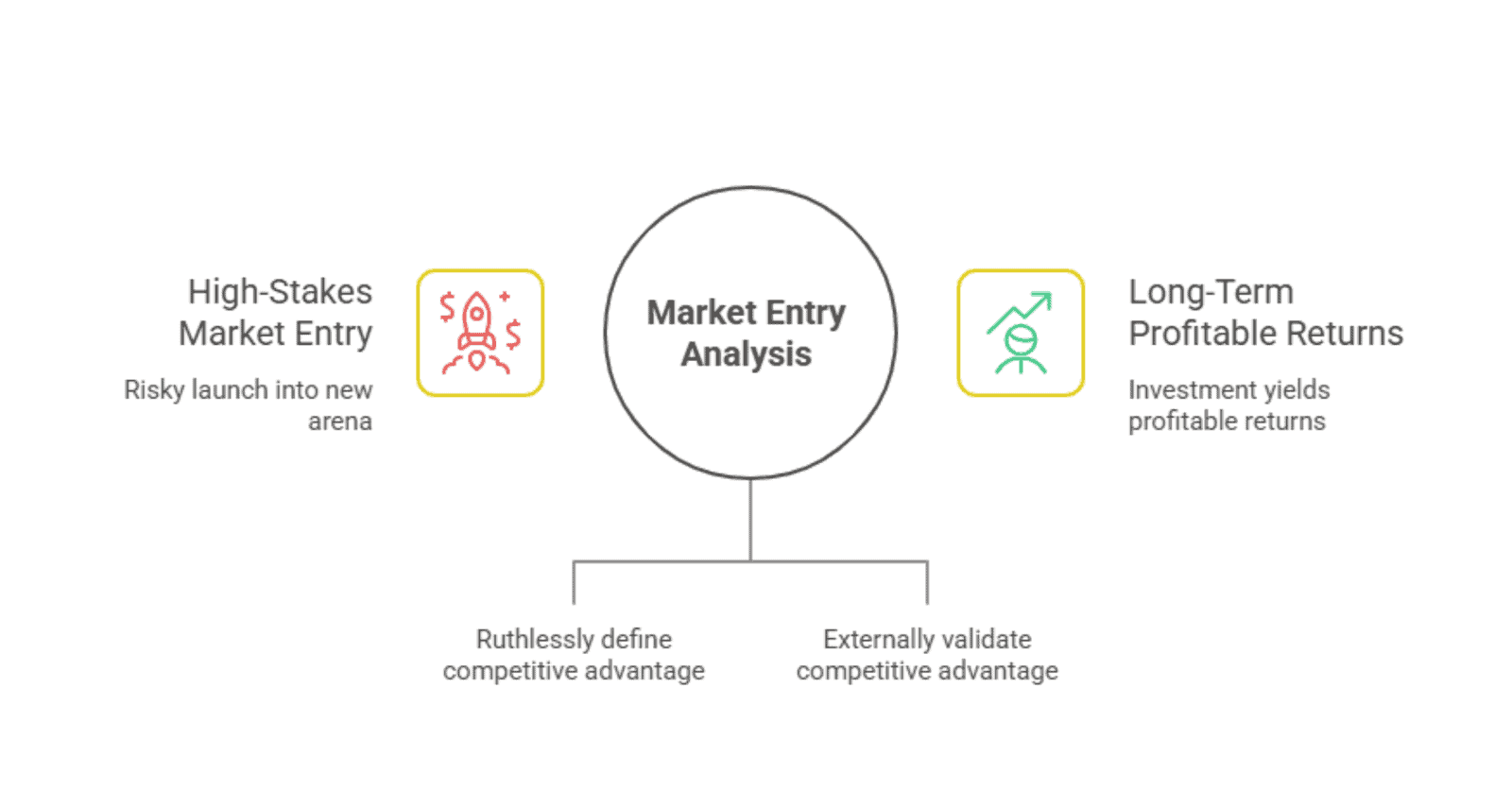

Launching a product or service into a new arena is a high-stakes move. It requires more than just identifying a large customer base; it demands a clear, strategic roadmap that proves you are not just another option, but the only logical choice for a specific customer. This roadmap is the Market Entry Analysis (MEA).

MEA is not merely a box-checking exercise for market sizing. It is a rigorous process of self-examination and external validation designed to answer one crucial question: Can we sustain a competitive advantage?

The goal of Market Entry Analysis must be to ruthlessly define and validate a sustainable competitive advantage, ensuring your investment yields long-term, profitable returns.

But what exactly is a competitive edge? It’s the unique factor, whether it’s cost, innovation, or customer experience, that allows a business to generate superior customer value and defend its market position against all rivals. If you skip this step, you’re not entering a market; you’re entering a lottery.

Phase 1: Landscape and Opportunity Mapping

Before you can define your edge, you must understand the terrain. Phase 1 is about establishing the foundational context of the market you intend to disrupt.

Market Definition and Sizing

A granular understanding of market size ensures you’re not chasing a ghost. You need to segment the market using the classic hierarchy:

- Total Addressable Market (TAM): The entire revenue opportunity if every single person who could potentially use your product did so. (The theoretical ceiling.)

- Serviceable Available Market (SAM): The portion of the TAM that your current business model and geography can realistically serve.

- Serviceable Obtainable Market (SOM): The realistic portion of the SAM you can capture in the first few years, factoring in competition and distribution limitations. This is your initial revenue target.

Beyond size, you must assess the market’s pulse: its growth rate, trends, and reliable future projections. Is the market expanding, stagnant, or contracting? A growing market is often more forgiving of newcomers than a mature, static one.

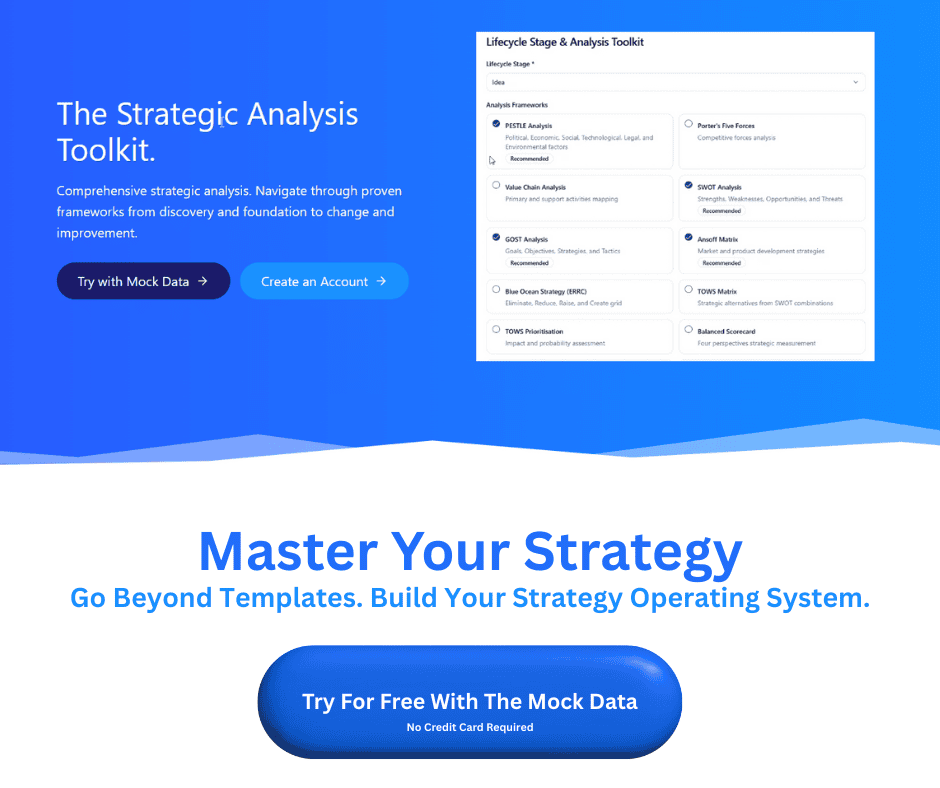

PESTLE/SWOT Context

A macro-environmental scan helps uncover external forces that could act as headwinds or tailwinds for your entry strategy.

- PESTLE: Quick overview of Political, Economic, Sociocultural, Technological, Legal, and Environmental factors. For instance, a new regulatory shift (Legal/Political) could simultaneously wipe out an incumbent’s advantage and create an opportunity for a digitally native solution (Technological) like yours.

- SWOT: Juxtapose your Internal Strengths and Weaknesses against External Opportunities and Threats. Your superior, patent-pending technology (Strength) might be perfectly positioned to capitalize on a sudden shift in demand for eco-friendly products (Opportunity).

The “Gap” Analysis

This is where the preliminary work truly begins to inform your strategy. The Gap Analysis involves scrutinizing incumbent players and identifying pain points or underserved customer segments that they have either missed or chosen to ignore.

A gap analysis answers the question: What market need is your company uniquely positioned to fill? This need might be:

- Too expensive: The gap is a need for an affordable alternative.

- Too complicated: The gap is a need for a simple, user-friendly solution.

- Too slow/inefficient: The gap is a need for higher performance or speed.

If you don’t find a meaningful, unmet need, a “gap,” you have no business entering the market yet.

Phase 2: Identifying and Profiling the Competition

You cannot define your edge in a vacuum. You must first map your rivals’ edges.

Direct vs. Indirect Rivals

Understanding your competitors requires careful classification:

- Direct Rivals: These are the companies offering an identical or near-identical solution to the same customer base. If you’re launching a productivity app, Asana and Trello are your direct rivals.

- Indirect Rivals (Substitutes): These companies solve the same customer need, but through a different method. If you’re selling a productivity app, using email or even a simple physical notebook is an indirect substitute. These are often overlooked but can pose the greatest threat because they represent established user behavior.

Competitor Deep Dive

A robust competitor profile moves beyond surface-level observations. You need intelligence on:

- Their current offerings, pricing models, and distribution channels.

- Their technology stack and infrastructure (as much as you can glean).

- Their marketing and sales strategy: Where do they spend their budget?

Most importantly, assess their core strengths, what makes them dominant and hard to displace, and their blind spots, the areas where they are vulnerable to a focused attack. Are they slow to innovate? Do they neglect small business customers? Is their customer service notoriously poor? These blind spots are the foundation for your entry strategy.

Strategic Positioning Map

The Strategic Positioning Map is a vital visualization tool. It charts rivals along two key axes, e.g., Price vs. Quality or Feature Richness vs. Ease of Use. The objective is to literally see the open “white space” that is both desirable to customers and defensible by your company.

Your entry point should target this white space. Trying to occupy the same crowded corner as the market leader is a recipe for a costly, unwinnable price war.

Phase 3: Defining Your Unique Value Proposition (UVP)

If you’ve identified the white space, Phase 3 is about building the product that fills it. This starts with articulating a laser-focused Unique Value Proposition (UVP).

The Core Question

Your UVP must provide a compelling answer to the most critical business question:

Why should a customer leave their current provider or solution and switch to you?

If your answer is merely “we’re cheaper” or “we have more features,” you will be copied or outcompeted immediately. Your UVP must be built on a strategic foundation.

The Three Pillars of Value (Where Your Edge Can Lie)

Strategic business consultant Michael Treacy and Fred Wiersema identified three core competitive disciplines. A truly successful company masters one of these pillars and maintains competence in the other two:

- Operational Excellence (Cost/Price): The strategy of achieving the lowest total operating cost to deliver the same quality product. Example: Amazon’s relentless focus on supply chain efficiency. Your edge here is in seamless processes, superior logistics, and waste reduction, which translate into the lowest market price for the customer.

- Customer Intimacy (Service/Experience): The strategy of providing hyper-personalized, tailored solutions and superior service, often targeting a particular, high-value segment. Example: Salesforce or niche wealth management firms. Your edge is relationship building, deep understanding of customer needs, and offering a total solution rather than just a product.

- Product Leadership (Differentiation/Features): The strategy of offering the most advanced, highest-performing product available. This means continuous innovation and premium positioning. Example: Apple or Tesla. Your edge is speed to market with innovation, superior R&D, and building a brand reputation synonymous with the cutting edge.

The UVP Statement Formula

An effective UVP is concise and actionable. Use this practical template to articulate your unique position:

For (Target Customer) who (Statement of Need/Pain Point), our (Product/Service) is a (Product Category) that (Statement of Key Benefit).*

Example: For (small, sustainable fashion brands) who (struggle with high minimum order quantity manufacturing), our (cloud-based 3D printing service) is a (textile manufacturing platform) that (allows on-demand, single-unit production at bulk-order prices).

This formula instantly communicates your target, your solution, and your competitive edge in a single statement.

Phase 4: Validating and Sustaining the Competitive Edge

Defining your edge is the start; validating its sustainability is the finish line. A competitive advantage that can be copied in six months is not an advantage; it’s a head start. This phase uses powerful strategic frameworks to test the strength of your position.

Validating Your Edge with Porter’s Five Forces

A competitive advantage that can be copied in six months is not an advantage; it’s a head start. You need a structural framework to assess the market’s external attractiveness and define the optimal entry position. Porter’s Five Forces provides this strategic view, moving beyond simple defense to guide positioning.

In the context of market entry, the Five Forces help validate the durability of your Unique Value Proposition (UVP) and the feasibility of your market position:

- Threat of New Entrants (Barriers to Entry): Your first line of defense is making it painful for the next entrant. How substantial are your Barriers to Entry? This might include high capital requirements, proprietary IP, or strong regulatory hurdles. Your edge must actively raise these barriers.

- Threat of Substitutes: Assesses how easily customers can solve their problem using a different product or service (your indirect rivals). If your product is so unique that switching to a substitute would be a significant compromise, your edge is strong.

- Bargaining Power of Buyers/Suppliers: Analyze if powerful buyers can squeeze your margins, or if powerful suppliers can drive up your costs. A strong UVP, especially one based on Product Leadership or Customer Intimacy, often reduces the buyer’s power.

By analyzing all five forces, you can strategically select the market segment where rivalry is weakest and where your competitive edge will be most effective and protected.

Building Economic Moats

The ultimate goal of Phase 4 is to build an economic moat around your business, a structural advantage that protects long-term profits from competitive attacks.

Three of the most powerful moats are:

- Network Effects: The product gets inherently more valuable as more people use it. Think about social media, marketplaces (eBay, Amazon), or communication platforms. If you can build a community or multi-sided platform, you create a potent, self-reinforcing competitive edge.

- Switching Costs: How difficult, expensive, or time-consuming is it for a customer to leave you for a competitor? This could be a data transfer nightmare, retraining costs for a software platform, or financial penalties for contract breakage. High switching costs create customer lock-in and provide stability.

- Intellectual Property (IP): Patents, trademarks, unique algorithms, or proprietary data sets. While patents eventually expire, they buy you crucial time to build the other moats (network effects and switching costs) while competitors are stalled.

Actionable Next Steps

Entering a new market is a significant investment, and success is not about optimism; it’s about preparation. By following the systematic steps of a rigorous Market Entry Analysis, you shift the odds dramatically in your favor.

A successful market entry is based on a validated, articulated, and defensible competitive edge; it’s not just a good idea, it’s a strategically protected one.

Your Call to Action: Stop searching for market opportunities and start building a fortress. Define your Unique Value Proposition, validate your position using Porter’s Five Forces, and design your entire go-to-market strategy around reinforcing your economic moats.

Final thought: Don’t enter the market hoping to find your edge; define it first, and make it impossible for anyone else to follow.