Stop Guessing, Start Winning: How to Build a Systematic Competitive Intelligence Program

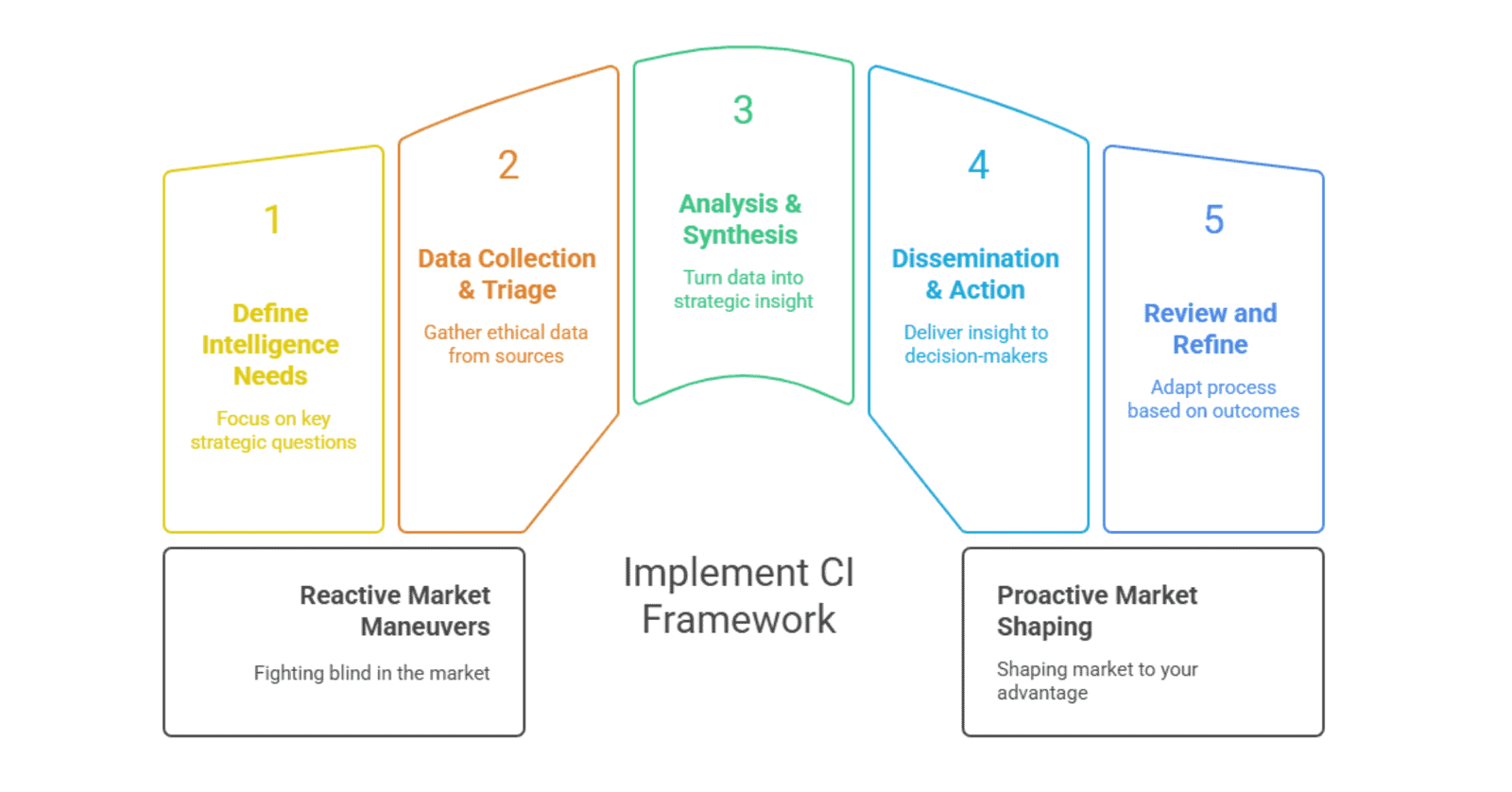

The market is a battlefield, and the vast majority of companies are fighting blind. They rely on gut feelings, anecdotal evidence from the sales team, and reactive maneuvers to respond to competitors’ moves. If a competitor’s new product launch has ever blindsided you, lost a crucial bid due to an unexpected pricing change, or watched a market trend emerge seemingly out of nowhere, you understand this pain.

The harsh reality? According to analyses by organizations such as the U.S. Chamber of Commerce, up to 60% of business failures could be prevented through proper, proactive market analysis and foresight. The most significant risk to your business isn’t necessarily internal; it’s the unknown forces lurking just beyond your line of sight.

This is where the discipline of Competitive Intelligence (CI) transforms your organization. CI is the engine that converts raw, scattered market data into strategic foresight; it is your ultimate, legal, and ethical competitive advantage.

A systematic approach to Competitive Intelligence is not optional; it is the indispensable engine for anticipating market shifts, identifying threats, and uncovering non-obvious opportunities for profitable growth.

Over the next few minutes, we will walk you through a proven, systematic 5-step CI Framework used by leading consulting firms to help you build a robust intelligence program that guarantees you always know what your competitor is planning before they execute it.

Defining Competitive Intelligence (CI): The Ethical Edge

Before we dive into the process, we must clearly define what Competitive Intelligence is and what it is absolutely not.

CI vs. Espionage: Drawing the Bright Line

There is a persistent, harmful misconception that CI is synonymous with corporate spying or industrial espionage. This is false and must be firmly rejected.

- Competitive Intelligence (CI): The ethical, legal, and systematic collection and analysis of publicly available data. This includes press releases, financial reports, job postings, social media, product reviews, and public speaking engagements. Its singular goal is strategic advantage through legal insight.

- Corporate Espionage: Involves illegal and unethical methods, such as the theft of trade secrets, hacking, bribery, or misrepresenting one’s identity. In the United States, this can lead to severe penalties under the Economic Espionage Act of 1996.

Competitive Intelligence is about seeing and synthesizing what is public but invisible to the untrained eye; espionage is about stealing what is private and secured.

A successful Competitive Intelligence program operates entirely above board and within the letter of the law.

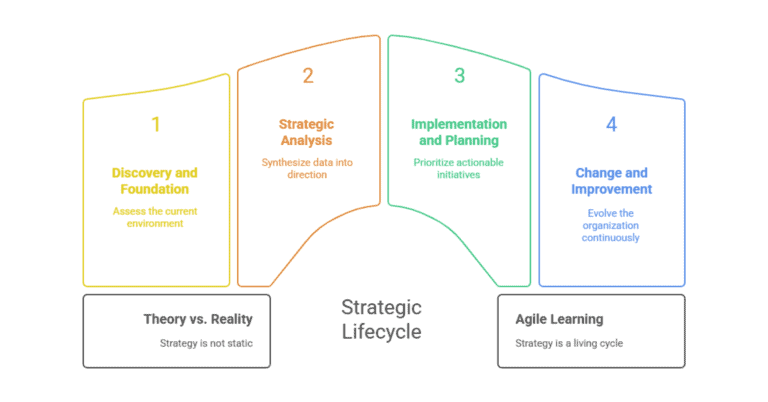

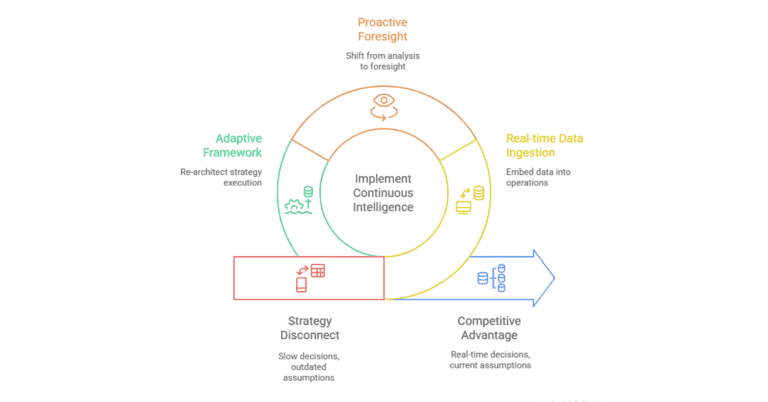

The CI Life Cycle (The 4 A’s)

All effective CI programs follow a continuous, systematic process. Think of CI as a loop, not a one-time project:

- Acquisition: Gathering legal and ethical data from primary and secondary sources.

- Analysis: Turning that raw data into clear, synthesized insight and implications.

- Action: Disseminating the insight to the right decision-makers in an actionable format.

- Adaptation: Reviewing and refining the entire process based on outcomes.

The ultimate strategic value of this cycle is anticipation. Your CI program should answer the critical question: “What is our competitor going to do before they do it, and what should our counter-strategy be?”

The Systematic 5-Step CI Framework

This framework provides the structure necessary to transform random data collection into a predictable, high-value strategic asset.

Step 1: Define Your Intelligence Requirements (The “Know” Phase)

The biggest mistake companies make is collecting data first and asking questions later. A systematic CI program always starts with the business strategy.

A. Focus on Key Strategic Questions (KSQs)

Your CI efforts must be driven by the challenges and uncertainties keeping your executive team up at night. These are your Key Strategic Questions (KSQs).

- KSQ Examples:

- “How will Competitor X’s new partnership with a major distributor impact our Q4 market access?”

- “What is the true timeline and budget allocation for Competitor Y’s rumored entry into the Asia-Pacific market?”

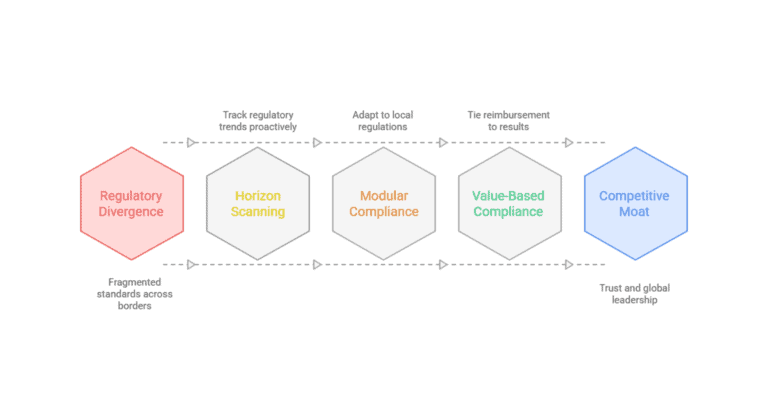

- “How is the new regulatory environment going to affect our competitor’s supply chain efficiency versus ours?”

B. Identify Key Intelligence Topics (KITs)

Group your KSQs into manageable themes, known as Key Intelligence Topics (KITs), which organize your collection efforts.

- Common KITs: Competitor Financial Health, Product Roadmap, Go-to-Market (GTM) Strategy, Talent Acquisition/Key Hires, Regulatory Vulnerabilities.

The importance of this step cannot be overstated: If the intelligence you gather does not directly address a KSQ, it is noise, not intelligence.

Step 2: Data Collection & Source Triage (The “Gather” Phase)

With your KSQs and KITs defined, you can now focus your data collection more efficiently.

A. Primary Sources (Direct)

These involve human interaction and often yield the most valuable, nuanced insights:

- Win/Loss Analysis: Systematically interviewing prospects who chose a competitor to understand why they defected.

- Conference and Trade Show Analysis: Observing competitor booth traffic, listening to their presentations, and legally engaging their sales representatives.

- Key Informant Interviews: Legally and ethically speaking with former employees, current customers, and industry consultants.

B. Secondary Sources (Public & Ethical)

The digital age provides an ocean of free, public data, if you know where to look:

| Source Category | Data Insight Revealed |

| Financial Indicators | Strategy, investment focus, profitability, and cost structure (e.g., SEC/company filings, earnings call transcripts). |

| Product & Technology | Upcoming features, R&D priorities, and patent focus (e.g., Patent filings, open-source contributions, technical forums). |

| Personnel & Direction | Geographic expansion, technology stack, and strategic direction (e.g., Job postings, LinkedIn profiles of key hires/departures). |

| Market Sentiment | Customer pain points and product weaknesses (e.g., Social media sentiment, online product reviews, Reddit forums). |

C. Source Confidence

Not all data is equally reliable. Implement a rating system for source confidence (e.g., A: Confirmed by three independent sources; D: Unverified social media rumor) to ensure your analysis is built on a solid foundation.

Step 3: Analysis & Synthesis (The “Insight” Phase)

Raw data is useless. Analysis is the alchemy that turns data into gold.

A. Strategic Frameworks for Interpretation

You must apply proven analytical frameworks to uncover non-obvious conclusions:

- SWOT Analysis (Applied to the Competitor): Understanding a competitor’s internal Strengths, Weaknesses, market Opportunities, and external Threats allows you to predict their likely actions.

- War Gaming: A crucial exercise where executives role-play as key competitors to simulate potential future moves. Example: If Competitor Z launches a disruptive new AI feature, what is our immediate, mid-term, and long-term response?

- Benchmarking: Systematically comparing feature sets, pricing models, and GTM channel efficiency.

B. Creating the “Competitor Profile”

The goal is to create a structured, living document for each key competitor that synthesizes all gathered data into a cohesive narrative. This profile includes: Strategic Goals, Core Competencies, Assumptions about the Market, Organizational Culture, and Likely Future Moves.

The most critical part of this step is synthesizing the “So What?”: Every finding must conclude with a clear, actionable implication for your company.

Step 4: Dissemination and Action (The “Impact” Phase)

The most insightful analysis is worthless if it sits in a report on a shared drive. Intelligence must be delivered to the right person, in the correct format, at the right time.

A. Tailored Delivery and Format

Intelligence must be custom-packaged for the audience to drive action:

- For the Sales Team: Create concise, easily searchable Battle Cards. These detail the competitor’s weaknesses, key talking points, and how to position your solution as superior.

- For Executive Leadership: Deliver short, high-level Strategic Alerts focused on proactive decision-making (e.g., “The data suggests Competitor X will pivot to a subscription model in Q2. Recommendation: Launch a one-time purchase option now to capture high-volume customers.”)

- For Product/R&D Teams: Provide detailed Feature Benchmarking Reports and gap analyses to inform the product roadmap.

B. Measuring Impact

A systematic program measures its return on investment (ROI). Track metrics like: Competitive Win Rate, time-to-market reduction for new features based on CI, and avoidance of strategic missteps.

Step 5: Review and Refine (The “Adapt” Phase)

Competitive Intelligence is a marathon, not a sprint. The cycle must be perpetual.

A. Process Audit

The market and your competitors are constantly evolving, so your questions must evolve, too. Review your Key Intelligence Topics (KITs) and Key Strategic Questions (KSQs) quarterly. Are you still asking the right questions?

B. Feedback Loop

Always follow up on the intelligence that led to a decision. If a competitor made a move that contradicted your forecast, you have a critical learning opportunity. Analyze why your forecast was wrong, and adjust your sources or analytical frameworks accordingly.

C. Technology and Automation

Invest in the right tools (CRM plugins, dedicated CI platforms) to automate the low-value tasks, the routine scraping and collection of public data, freeing your analysts to focus on high-value, human-driven synthesis and interpretation.

CI is Your Sustainable Competitive Advantage

Competitive Intelligence is not an obscure function; it is a fundamental strategic capability. It shifts your business from a state of reaction (always playing catch-up) to a position of proaction (shaping the market to your advantage).

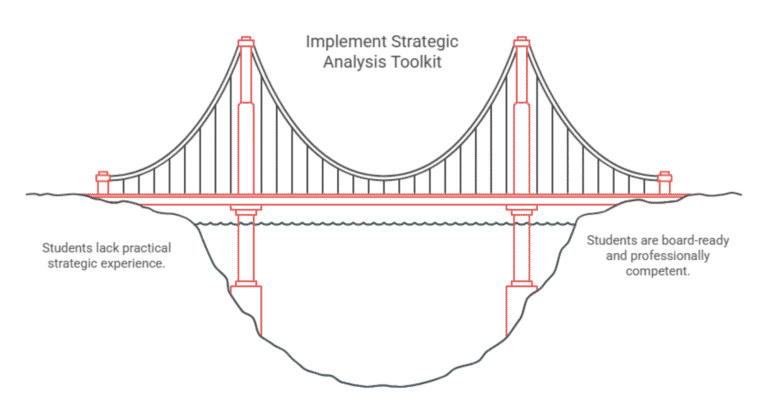

The cost of ignorance always outweighs the cost of intelligence. With up to 20% of startups failing in their first year and the average corporate lifespan shrinking, the risk of not knowing your market is exponentially higher than the investment required for a systematic CI program.

It’s time to stop fighting blind and start making data-driven decisions that anticipate the future.

Your Next Step

Don’t try to implement this entire framework overnight.

Start simple: Identify your top three market threats and your top three Key Strategic Questions (KSQs) for the next six months. Assign a clear data collection and analysis plan to each, and take the first step toward building your systematic competitive edge.